FHSD Provides Informational Update on 2024 Tax Bills

Forest Hills School District has received some questions from community members regarding the newly released tax bills for the 2024 Collection Year and how the district’s recent combination levy may be having an impact.

While the school district is not an authority on tax information, the hope is to provide some basic clarification on matters that do relate to district business and connect residents and taxpayers to helpful resources to learn more about their individual tax bills. Any specific questions about tax bills should be directed to the Hamilton County Treasurer. This article is simply meant to provide general information and helpful context.

FHSD Treasurer Alana Cropper presented similar information at the January 17, 2024 Board of Education meeting. You can watch her presentation on the district’s YouTube page and can view her presentation slides here.

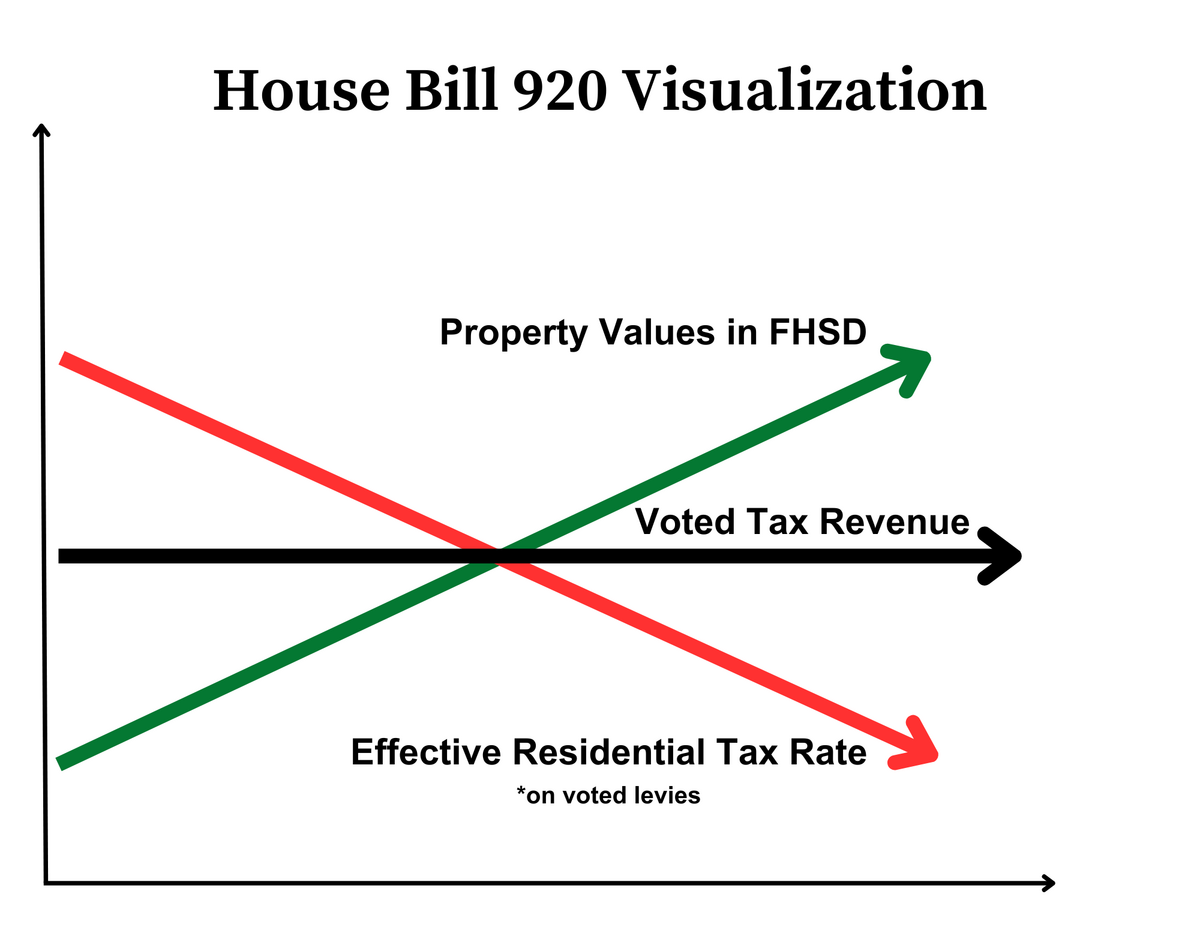

Understanding House Bill 920

In terms of school funding in Ohio, one important piece to understand is House Bill 920. This state law effectively freezes the amount of voted tax levies to protect homeowners and residents from facing inflationary tax increases as property values increase. This means when property values increase, the effective tax rate in a district decreases because only the amount approved by voters can be collected.

As an example, FHSD’s effective tax rate in the 2023 Collection Year was 38.89 mills. If the 6.9 mill combination levy approved by voters was added to this amount, the new millage would be 45.79 mill. However, HB 920 requires the Hamilton County Auditor to reduce the effective tax rate in response to rising home values. The district’s effective tax rate for the 2024 Collection Year actually went down to 36.24 mills. (Source: Hamilton County Auditor’s 2023 Residential Tax Rate and 2024 Residential Tax Rate)

This reality is what leads to many school districts returning to taxpayers with additional levy requests over time.

Important exceptions to HB 920 are inside millage and new construction. Inside millage describes the ability of all local governments to levy a total of 10 mills without a vote of the people. This particular millage, known as inside millage, increases in accordance with rising property values. FHSD receives 5.33 of these 10 inside mills. From Collection Years 2012-2024, the increase in tax revenue due to inside millage has averaged $89,075.85 per year. When compared to the district’s current total budget of roughly $117 million, the average increase due to inside millage accounts for .076% of that amount.

When new construction is built in the school district, it is counted as a one-time increase in the year it is added to the tax rolls. The amount these properties pay in relation to voted levies is an increase in the original amount stated on the ballot. Historically, the amount of new construction as a percentage of total valuation has been less than 1%. From Collection Years 2012-2024, the amount of new construction as a percentage of total valuation averaged 0.33%. (Source: FHSD New Construction and Inside Millage Breakdown)

Impact of 2023 Home Reappraisals

Many homeowners in FHSD saw an increase in their property values during the Hamilton County Auditor’s reappraisals in 2023, which came into effect for the 2024 Collection Year. This table from the Hamilton County Auditor’s website details the percentage increase in total property value for Cincinnati and other municipalities in Hamilton County. For the purposes of this article, FHSD is looking specifically at residential property values because these impact the most people and make up the largest portion of the tax base in Forest Hills School District.

According to the chart linked above, Anderson Township and the Village of Newtown both experienced significant property value increases, although each was below the county average.

- Total Residential Property Value Increase via 2023 Reappraisals

- Hamilton County: 34.19%

- Anderson Township: 30.46%

- Village of Newtown: 26.94%

- Hamilton County High - Lincoln Heights: 115.37%

In an effort to provide a simplified example of how changing property values might impact tax bills, FHSD will list the following three residential properties in Anderson Township along with important items to consider. Please keep in mind that this is not meant to provide a standard of comparison for different homes in the school district. Each individual tax bill should be examined separately as there are various tax credits, special assessments and other factors that might impact a final tax calculation.

In the following example, Home A represents an actual property that increased in value less than the average of Anderson Township. Home B represents an actual property that increased in value roughly in line with the average and Home C represents an actual property that increased in value well above the average. The district redacted addresses and other personal information from the presentation to protect the identity of the homeowners.

|

Home A |

Home B Value Increase Average |

Home C Value Increase Above Average |

|

| Previous Value | $294,000 | $312,850 | $129,950 |

| New Value (2023 Reappraisal) | $334,420 | $413,460 | $203,310 |

| % Increase in Value | 13.75% | 32.16% | 57.22% |

| Expected New Taxes (Hamilton County Auditor data) | $983.23 | $1,215.57 | $600.69 |

| Actual Change in Tax Bill | +$87.44 | +1,302.29 | +1,220.90 |

| Difference | $895.79 less than expected | $86.72 more than expected | $610.21 more than expected |

The amount of expected new taxes for each property was calculated by adding the “estimated annual tax” amount for each “additional” and “increase” levy under the Levy Information tab on the Hamilton County Auditor’s online property search portal. As illustrated in the chart, properties that increased in value below the average across Anderson Township (Home A) might see a lower than expected tax increase. Whereas properties that increased well above the average amount (Home C) might see a larger increase in their tax bill than anticipated. Part of the reason for this is that the latter home now makes up a slightly larger portion of the total taxable value in the school district.

Although existing properties do not produce any additional revenue on voted school levies, changing property values can have an impact on the amount of taxes charged to individual homeowners as the total amount is divided across all property in the school district.

Helpful Resources on the Hamilton County Auditor’s Website

The Hamilton County Auditor’s website contains a wide variety of current and historical data related to property values and tax rates. By utilizing the property search feature, homeowners can look up a variety of information related to their property including:

- Value History

- Allows you to look up past and present property reappraisals

- Provides information about how the value of a particular property has changed over time

- Levy Information

- Provides data from the Hamilton County Auditor related to the anticipated cost of new taxes from voted levies

- IMPORTANT NOTE: This indicates estimates that were calculated in 2023 prior to the property reappraisals. It is likely that the actual cost will be different due to the significant change in overall property value.

- Payment Detail

- Allows you to look up detailed information on current and past tax payments

- Note the “Total Owed” section in BOLD

- Provides details on the Effective Tax Rate and Total Taxable Value

- Tax Distribution Information

- Provides information on the current Tax Rate, Tax Calculations, Half Year Tax Distributions and a graph that illustrates what percentage of property taxes go to different entities

- Anderson Township: 56.9% of property taxes goes to FHSD

- Village of Newtown: 58.8% of property taxes goes to FHSD

In order to access this information, start by visiting the Hamilton County Auditor’s website at https://www.hamiltoncountyauditor.org/

On the homepage, you can select “Property Search” from the menu on the left side of the screen. This allows you to search for your property by owner name, street address and more. After selecting a property, the menu on the right side of the screen includes the categories listed above and others that may be helpful in fully understanding different nuances of your property taxes.

You can find visuals to better understand what the different webpages look like and how to navigate the menus in Treasurer Cropper’s presentation slides.

As mentioned at the beginning of the article, any specific questions about your tax bill should be directed to the Hamilton County Treasurer. For questions about the 2023 school levy or other items related to FHSD, you can call Central Office at (513) 231-3600.