FHSD Presents Annual Update to Five-Year Financial Forecast

Forest Hills School District Treasurer Alana Cropper presented the annual May update to the Five-Year Forecast Financial Report to the Board of Education at the May 2024 meeting. Treasurer Cropper presents an initial five-year forecast each November, and provides an update to the report in May. The report serves as a planning document to assist with fiscal management and accountability by showing historical and projected revenue and expenses.

This document provides estimated financial projections and will adjust over time to reflect changing factors that impact the district’s finances. For example, this version of the five-year forecast takes into account any additional data that has become available since November. Any changes or adjustments at the state level in regards to school funding can rapidly change projections in the forecast between updates.

You can view Treasurer Cropper’s slideshow presentation here, read the full Five-Year Forecast Financial Report here and watch the presentation during the Board Meeting here. You can find additional information about the five-year forecast by visiting the district’s dedicated webpage to the document here.

The forecast analyzes the district’s General Fund, which is used to pay for staff salaries and benefits, purchased services from outside contractors and supplies and materials that support classroom education. The General Fund accounts for approximately 80% of the school district’s total budget and supports the majority of the day-to-day operations for FHSD. Other funds include permanent improvement, food service, bond retirement and more.

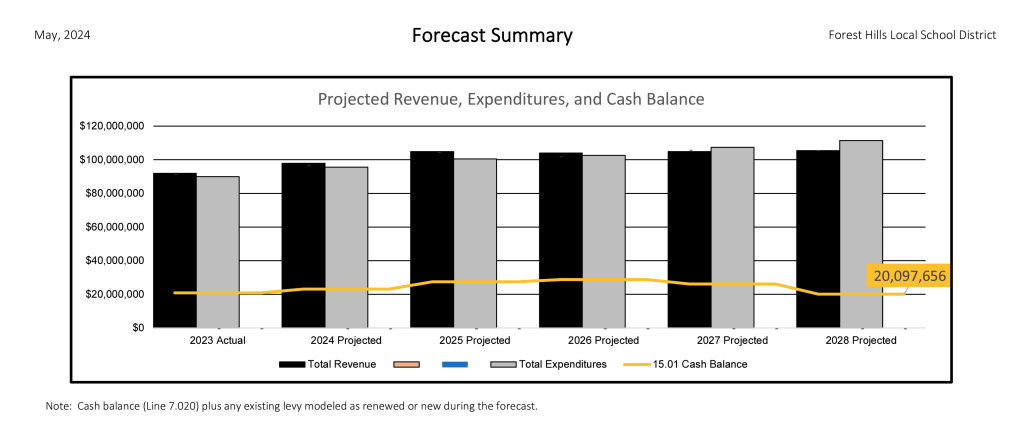

The May 2024 forecast includes revenue from the combination levy that was passed by voters in Forest Hills last May. Those taxes began to be collected at the start of calendar year 2024, and the total amount of the tax revenue will remain the same, regardless of any potential changes in home values. Treasurer Cropper explained in her presentation that revenues from the 5.4 mill operating levy are added to the General Fund to support existing academic programs and other operations of the school district. For fiscal year 2024, which lines up with the 2023-2024 school year and ends on June 30, 2024, the forecast anticipates the General Fund operations to conclude with a $2,277,773 positive difference between revenues and expenditures. Treasurer Cropper explained that without the most recent levy, the district would be in deficit spending.

Based on projections in the forecast, the General Fund is expected to see its cash balance increase over the short-term. However, costs are also expected to continue to rise due to factors outside the district’s control. Inflationary increases in the cost of items like food, fuel, energy and more continue to impact the district’s financial bottom line. General Fund expenditures could exceed revenues as early as fiscal year 2027. Based on the projected ending cash balance values, the district does not anticipate a need to request a new levy during the timeframe covered by this report.

Some key changes between the November forecast and May update include a slightly higher than expected revenue for the current fiscal year by approximately $854,554 or 0.9%. That, coupled with slightly lower than projected expenditures for the year of approximately $862,038 or -0.9%, is now factored into the past trends and future projections. This means the projected ending cash balance for the current fiscal year is now anticipated to be roughly $1.7 million higher than was projected in November.

The five-year forecast is simply the district’s best estimation as to what will happen in the future. Many variables that affect the five-year forecast are currently unknown and out of our control (i.e. state funding, inflation to name a couple) and the forecast will be updated as those unknowns become known. Despite those challenges, Forest Hills School District remains committed to responsible fiscal planning and anticipates being able to stretch the funds from the most recent levy beyond the promised timeframe of three years.

Treasurer Cropper also presented information about where the district’s funding comes from and how that is changing over time. Currently, nearly 73% of General Fund revenues come directly from local taxpayers. State funding accounts for about 25% of the General Fund revenues. As recently as 2019, the local share was approximately 64% and the state share was about 32%. As state funding struggles to keep pace, the local community is forced to shoulder more of the burden.

Although salaries and benefits account for 82% of total expenditures in the General Fund, district leaders continually search for ways to operate more efficiently while still delivering an extremely high-quality education to students in the community. In the past four school years, more than $1.9 million has been reduced in staffing costs through attrition and other cost-saving measures. Since 2018, the district has reduced 26 full-time equivalent positions. Efforts like these are important to reducing costs and meeting the district’s obligation to be a strong steward of public funds.